Applying behavioural science for Lowell to foster a better customer experience

1st March 2024

Walnut Unlimited

Using behavioural science and consumer insight, Lowell optimised its business strategy and improved not just the website but hundreds of communication.

Covid-19 accelerated digital adoption and the demand for seamless digital experiences.

It has never been more important to meet customers’ evolving needs and their increasing expectations around digital engagement. Accelerated by the pandemic, consumers are ever more turning to digital channels to access a plethora of services*. For organisations such as Lowell, this means designing, and continually refining, a streamlined, accessible digital customer engagement model that mirrors broader digital behaviours.

But how do you design an online service when customers might distrust you, and may even seek to avoid you?

Financial services has struggled with distrust for years, with the sector being amongst the least trusted according to Edelman’s Trust Barometer. Within the field of debt collection, this inherent distrust declines further. Why? Because some debt companies are known for insensitive and forceful communication tactics: inciting fear and potentially causing financial stress.

Lowell adopt a different approach, looking at debt with sensitivity; to support and guide customers in an empathetic way. Below we explore how behavioural science has helped shape Lowell’s digital customer journey, whilst aiming to overcome customers’ inherent distrust.

How behavioural science can drive a better customer experience.

By applying behavioural science Lowell are able to better understand the emotions and deep-set biases associated with debt and money management. As humans we don’t always make rational decisions, and we can’t always explain why we do what we do. Through a behavioural science lens, Lowell can create better designed digital services that help overcome these deep-rooted biases and take customers on a stress-free digital journey.

Over the last year or so, Lowell have made fundamental strategy changes, grounded in behavioural science learnings and consumer insight from research conducted by Walnut Unlimited. This has contributed to an improved customer experience, evidenced in customer feedback tools such as Rant and Rave.

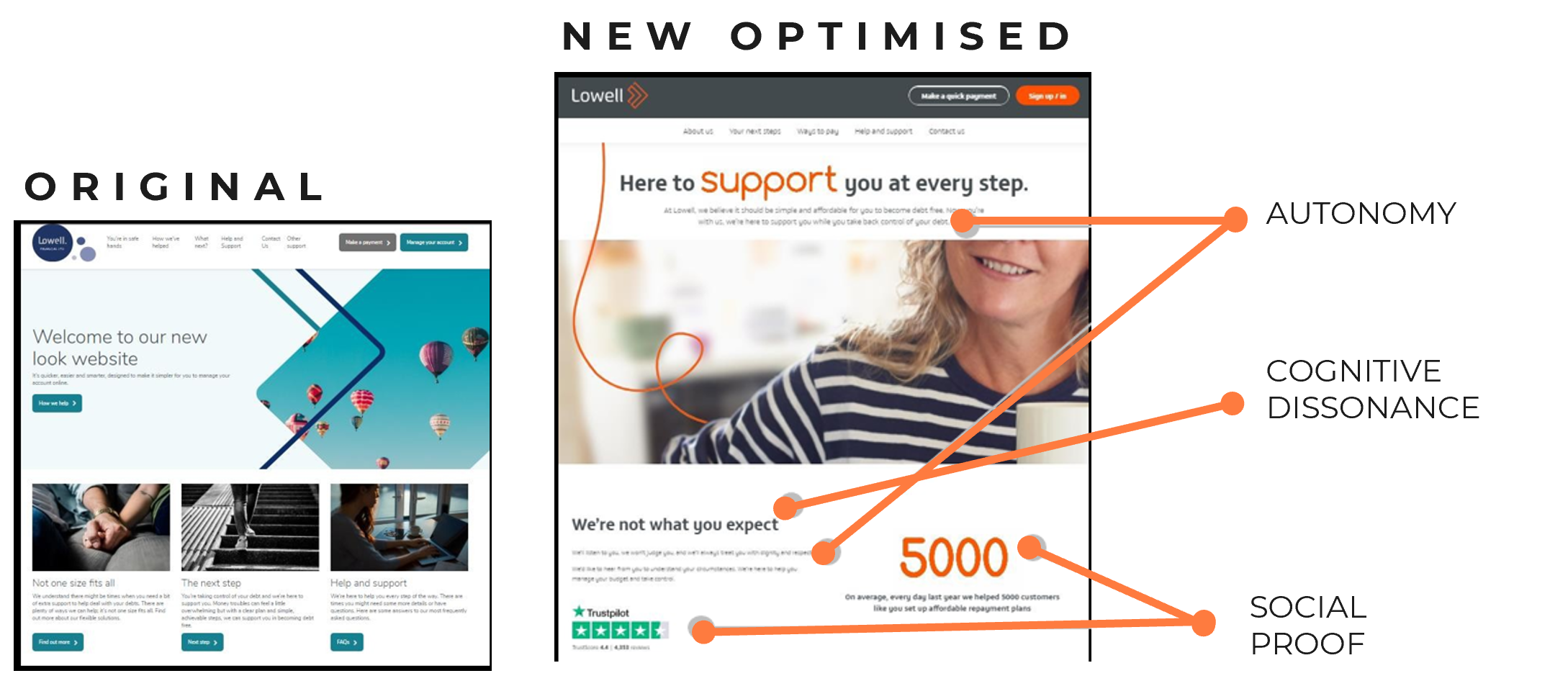

Examples of behavioural science principles applied throughout Lowell’s website (www.lowell.co.uk)

Below are a few examples of the cognitive biases and heuristics that are at play when engaging with debt collection services and how these were applied by Lowell to better respond to customers’ needs using Walnut Unlimited’s behavioural science framework – called Shortcuts.

Research conducted by Walnut Unlimited shows that customers have a turbulent relationship with debt companies, never forming a bond with a brand. Lowell dealt with this challenge head on by creating cognitive dissonance within customers – challenging their perceptions of what a debt company is and what it stands for.

- Cognitive dissonance is the tension that results when there is a mismatch between our beliefs and our actions. Lowell sought to resolve this psychological discomfort by changing either our beliefs or our actions so that they align and challenge the underlying beliefs directly, and to this end, included in all their communications that they are different to the rest of the sector, giving examples of their customer-first focused approach.Differentiating also breaks customers’ memory patterns and draws their conscious attention. Furthermore, clearly stating upfront that Lowell is not what customers would expect also taps into people’s curiosity, which is a strong human motivator – when teased with a small bit of information, people will want to know more.

- When it comes to engagement, we know that giving autonomy is imperative. Human beings like to feel that they have control or influence over something. Existing research told us that those in debt feel out of control and at the mercy of their creditors so the key to making them engage is to regain a sense of autonomy. This feeling of control over one’s finances, and therefore their lives, was implemented effectively throughout Lowell’s website putting the customers at the heart throughout the communications.

- We tend to follow the patterns of similar others, especially in new or unfamiliar situations. This is particularly relevant to experiences with debt as people feel very alone and rarely want to discuss their situation given its perceived taboo nature. Thus, to make their digital engagement feel more familiar and trusted, Lowell gave encouragement through the principle of social proof, showing evidence of others going through the same journey, and importantly, that with support from Lowell, anyone is able to successfully become debt-free. This was well implemented on Lowell’s homepage by showing the large number of people that Lowell has helped along with a high rating on Trustpilot from past customers.

How these changes made Lowell a stronger brand that customers engage with…

Using behavioural science and consumer insight, Lowell optimised its business strategy and improved not just the website but hundreds of communications. This led to greater engagement with the brand demonstrating a deepening trust in Lowell. Behavioural science principles helped to position Lowell’s business and strategy in a way that resonates with its customers on a more emotional and impactful level. As a result, Lowell were shortlisted in the highly acclaimed 2020 Marketing Week Awards for Brand Purpose alongside some well-established household brands.

*According to new data from IBM’s U.S. Retail Index, the pandemic has accelerated the shift away from physical stores to digital shopping by roughly five years. https://www.ibm.com/industries/retail-consumer-products

More Insights

Exploring attitudes towards debt policies supporting people who are struggling with debt burden in Britian – March 2024

It drew me in… Christmas advertising is not only about storytelling, it is about the story of us as humans

NEWSLETTER

Sign up for the latest treats straight to your inbox